unrealized capital gains tax california

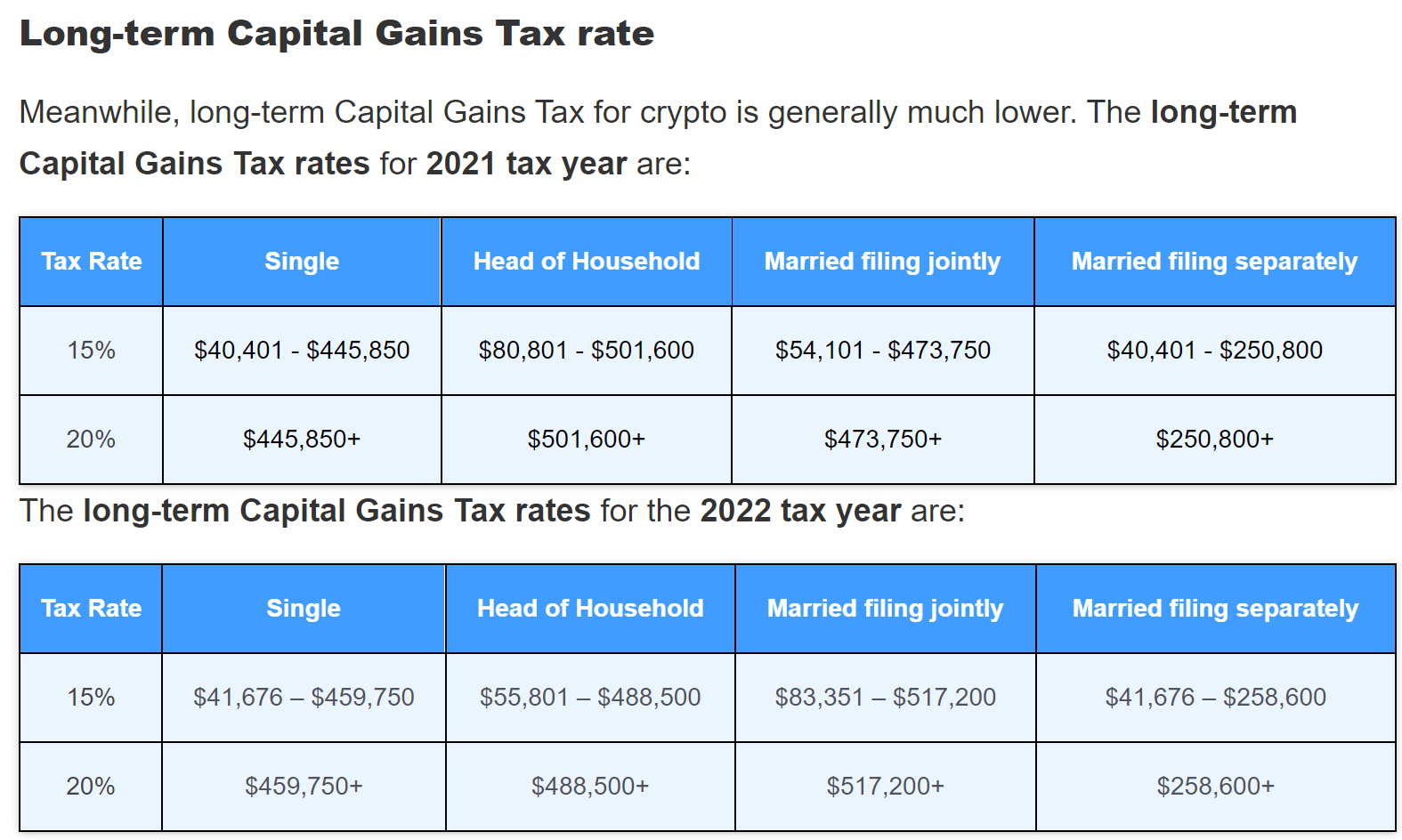

A tax on unrealized gains would harm the economy. Theyre subject to a 0 15 or 20 tax rate depending on your level of.

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Connect With a Fidelity Advisor Today.

. If you have a 500000 portfolio be prepared to have enough income for your retirement. To report your capital gains and losses use US. This California capital gains tax rate applies to.

What is the capital gains tax rate. A 04 tax on residents. In California HSA accounts are treated as a normal investment account.

Taxpayers impacted by the tax on unrealized gains will be incentivized to move overseas in order to avoid the tax moving. Some like Texas and Florida have no state income taxes either. California just treats HSA accounts as if they are taxable accounts.

The Problems With an Unrealized Capital Gains Tax. Californias proposed wealth tax Bill 2028 would apply for a decade to anyone who spends 60 days in the state in a single year. California taxes capital gains as a source of income without the IRSs differentiation between long-term or short-term gains.

This is often a surprise to. The exact magnitude of the capital gain is 2000 gross proceeds minus 1000 cost basis resulting in a long term capital gain of 1000. Unlike federal capital gains rules Californias capital gains tax rate for 2022 is independent of the duration of the gain.

Capital Gains Tax Deferral. Bitcoin and other assets facing Californias 133 tax on capital gains to. Long-term capital gains are gains on investments you owned for more than 1 year.

California State Capital Gains Tax. Wealth tax on millionaires. California taxes ordinary income and capital gain the same up to 133unless the rate goes up.

Thus capital gains and losses are reported in the year in which the investment fund buys or sells the. Bidens proposed wealth tax styled as a minimum income tax on households worth more than 100 million will claim at least 20 of both income and unrealized capital. For example the top ordinary Federal income tax rate is 37 while the top.

If you have a. An additional 1 tax on income over 1 million 3 on income over 3 million and 35 on income over 5 million. An investor that re-invests capital gains into a Qualified Opportunity Fund can defer the.

Talk of California adopting a tax on paper profits or unrealized capital gains on securities portfolios is already alarming among some in the Bay Area business community. While some states have no state taxes California has a top tax rate of 133. Ad Make Tax-Smart Investing Part of Your Tax Planning.

The problem may be with your improper use of the terms realized and unrealized earnings. Capital Gains Tax Rate in California 2022. Individual Income Tax Return IRS Form 1040 and Capital Gains and Losses Schedule D IRS Form 1040.

Here are the details. Most investors pay capital gains taxes at lower tax rates than they would for ordinary income. With California not giving any tax breaks for capital gains you could find yourself getting hit with a total state tax rate of 133 on your capital gains.

There are primarily three tax benefits made with the creation of OZs. 1 week ago Mar 21. The capital gains tax rate California currently plans for is one.

If you hold an asset for less than one year and sell for a capital gain the. California taxes capital gains as ordinary income and can vary from 1 to 13. Now that weve looked at what a tax on unrealized capital gains could be like its time to point out three significant.

Unrealized Capital Gains Tax. The amount youll pay in capital gains taxes depends primarily on how long you held an asset. Other states range from low tax states with capital gains rates around two percent up to high taxing.

This profit is a capital gain. Ad Download The 15-Minute Retirement Plan by Fisher Investments.

Capital Gains Tax Deferral Capital Gains Tax Exemptions

It S No Secret To Save State Budgets End Preferential Treatment Of Capital Gains Itep

Made A Killing With Crypto In 2021 How To Calculate Your Tax Bill

How To Avoid Paying Taxes On Inherited Property Smartasset

Mail Norberto Cruz Herrera Outlook City State California State Teacher Retirement

Capital Gains Tax On Inherited Property Bhhs Fox Roach

/images/2021/08/16/cryptocurrency-taxes.jpg)

9 Different Ways To Legally Avoid Taxes On Cryptocurrency Financebuzz

How To Calculate Capital Gains Tax H R Block

California S Public Employee Unions Want Tax On Unrealized Capital Gains San Francisco Business Times

Thoughts On Virtual Crypto Currency Taxation In The Us Htj Tax

Thoughts On Virtual Crypto Currency Taxation In The Us Htj Tax

Capital Gains Tax Deferral Capital Gains Tax Exemptions

How To Calculate Capital Gains Tax H R Block

How To Avoid Paying Taxes On Inherited Property Smartasset

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

California Proposes 16 8 Tax Rate Wealth Tax Again Time To Move

Capital Gains Tax Deferral Capital Gains Tax Exemptions

Thoughts On Virtual Crypto Currency Taxation In The Us Htj Tax